HRM Council is currently working through the budget for 2023/24. This budget will be developed through the end of March 2023, and is planned to be ratified by HRM Council in April 2023.

I plan to document this process as we go through it, including some of the more challenging decisions that we make.

You can also find much of this information here.

Budget Meeting Schedule

You can find the full schedule of our meetings here. This schedule was also originally determined from our Committee Of The Whole meeting here but was amended. The agenda and supporting information, for each meeting, is put on the web site a few days in advance of the meeting, usually on the Friday before the meeting. Any meetings that don’t have the agenda posted will redirect back to the schedule page.

- Oct 26 (Tue) – Launch, and approval of the Business Planning and Budget Schedule – Agenda, Report, and Video

- Nov 25 (Fri) – Agenda, Fiscal Framework Report, Presentation, Video, and Minutes

- Jan 18 (Wed) and Jan 20 (Fri) – Agenda, Capital Plan Report, Draft Capital Plan, Capital Plan Presentation, Jan 18 Video, Jan 20 Video

- Jan 25 (Wed) – Agenda, Budget Direction, Presentation, and Video

- Jan 27 (Fri) – Agenda, CAO budget, Finance budget, Legal budget, and Video

- Feb 3 (Fri) – Agenda, HRM and RCMP budget, and Video

- Feb 8 (Wed) – Agenda, IT budget, HR budget, Property, Fleet, and Environment budget, and Video

- Feb 10 (Fri) – Agenda, Library budget, and Video

- Feb 14 (Tue) – Agenda, Public Works budget, and Video

- Feb 15 (Wed) – Agenda and Video – Contingency from Feb 14

- Feb 17 (Fri) – Agenda, AG budget, Planning budget, Parks & Recreation budget, and Video

- Feb 22 (Wed) – Agenda and Video – Contingency from Feb 17

- Mar 1 (Wed) – Agenda, Transit budget, Halifax Fire budget, and Video

- Mar 3 (Fri) – Agenda, Fiscal budget, and Video

- Mar 8 (Wed) – Agenda and Video – Contingency from Mar 1

- Mar 29 (Wed) – Agenda, Budget Adjustment List, and Video

- Apr 25 (Tue) – Council Agenda, 2023/24 Budget and Business Plan, and Video

Public Participation

Our budget process allows for public participation at most of our meetings. If you would like to present to the Budget Committee at the meeting then you should register with the Clerk’s office by 4:30pm on the day prior to the meeting. You can contact the clerks office by e-mailing clerks@halifax.ca or by phoning them at 902-490-4210 (Mon-Fri, 8:30am-4:30pm).

On Friday, Feb 17, we had 36 speakers for Public Participation. I would like to thank all of them for coming out and showing their interest.

Tax Bill Changes

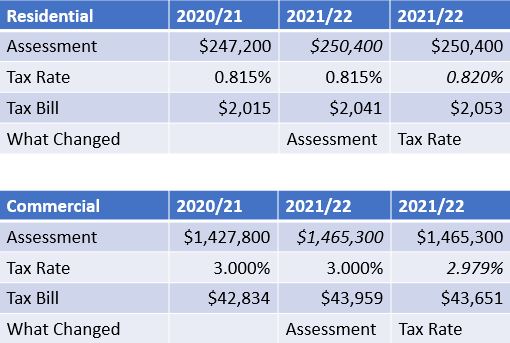

When we talk about the tax changes we are talking about the change to the tax bill. The tax bill is the Assessment multiplied by the Tax Rate.

The calculation, below, shows what we were considering for the 2021/2022 fiscal year. In this year we were looking at an increase in the average tax bill by about 1.8%.

The table below shows the average residential assessment increased from $247,200 to $250,400. To increase the tax bill by 1.8%, from $2,015 to $2,053, we needed to increase the tax rate from 0.815% to 0.820%.

That table also shows that the average commercial assessment changed from $1,427,800 to $1,465,300, which is a larger increase than 1.8%. To increase the tax bill by 1.8%, from $42,834 to $43,651, we lowered the tax rate from 3.000% to 2.979%.

The amount that the tax rate changes is directly influenced by the amount that the assessment changes. For this reason we talk about the tax bill changes, not the tax rate changes.

Budget Adjustment List

The Budget Adjustment List is a list of items that we will build through the budget process and then decide on at the end of the process (once we have a better view of the entire budget).

The current budget adjustment list (as of 20-Mar-2023) has about 40 items on it. Most of them have been costed by now.

We started the budget process with a tax increase of 8%. At this point (recognizing that not all of the items are costed) we are looking closer to a tax increase of 6%. This is still below the CPI (Consumer Price Index – Cost of Living) increase that was 7-8% last year.

You can find the current draft Budget Adjustment List here: http://www.paulrussell.ca/wp-content/uploads/20230320-Budget-Adjustment-List.pdf

Please keep in mind that this list is subject to change.